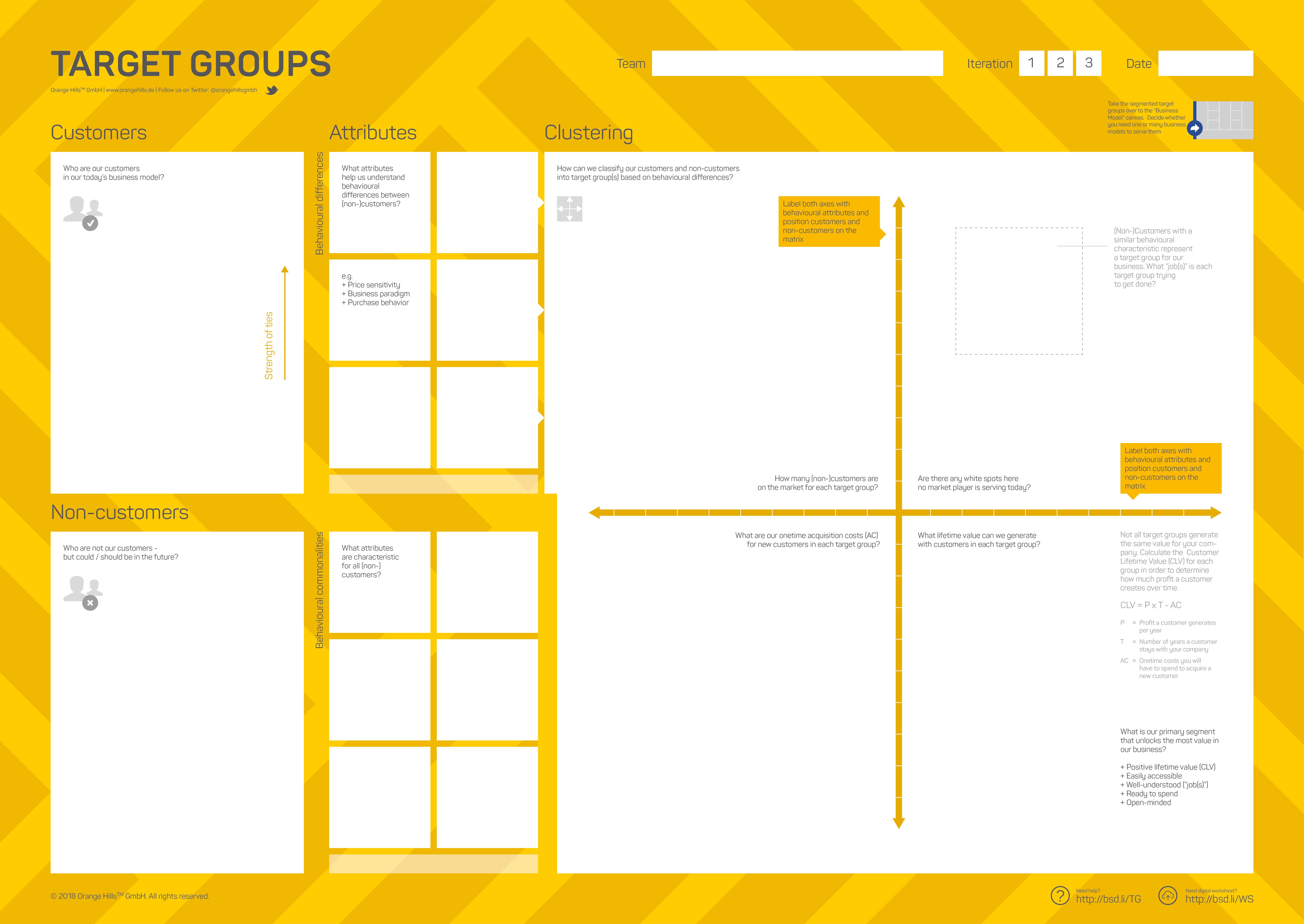

Target Groups

The Target Groups template gives you guidance in how to cluster customers into groups based on behavioural attributes. Read more about key elements, usage scenarios and download the template for your team.

1. Overview

The idea here is that we try to find attributes that help us describe relevant behaviour of customers concerning how they choose, buy or use products and services in your scope. We ignore typical demographic attributes such as age, gender, income, education etc. gender. The reason is simple: Somebody with a high income is not necessarily ready to spend money. The first is a demographic attribute (= income) and the latter a behavioural attribute (= ready to spend). Customers with similar behavioural patterns may want similar products and services. Customers with different patterns may need different offerings. Sounds easy? It isn't. Coming up with good behavioural attributes that explain the difference between two type of customers is often difficult and takes a while. The general procedure is a s follows:

Collect a bunch of real or potential customers.

Do the same for non-customer you don't serve today but could become customers in the near future

Brainstorm behavioural attributes that helps you understand differences between customers (e.g. willingness to outsource, price sensitivity, brand loyalty).

Also select a range of commonalities all customers share.

Now, the science becomes art: Put two random behavioural attributes (differences) on the two axes (x, y), e.g. price sensitivity low/high and brand loyalty low/high, and place the customers on the matrix accordingly. If you find it difficult to decide which attributes to choose, try it the other way around: Group customers first that "behave" similar and ask yourself afterwards how the groups differ.

Review the matrix according to the following criteria: Are your customers widely distributed so that they cover most of the matrix (> 70%)? If yes, good. If no, try other attributes to get a wider spread (go back to 5.).

Identify dedicated target groups by circling customers close by. Describe a "Job(s) to get done" statement and a customer card for each group.

Try to estimate the market size for each target group / segment. Consider "Total Adressable Market" (TAM), "Serviceable Addressable Market" (SAM) and "Serviceable Obtainable Market" (SOM). Calculate the "Customer Lifetime Value" (CLV) for each group (see formula on worksheet).

Optional: Map competitors on the matrix to see which competitor is serving which customer segment today and to identify "overserved" or "underserved" market areas.

Optional: Reflect which target groups could be further developed to more valuable customers - see Schrage M.: Who do you want your customers to become? (Amazon)

If the behavioural attributes are chosen wisely the matrix allows you to bundle customers to target groups, in which customers show a similar behavioural patterns when it comes to choosing, buying or using products and services in your scope.

2. Layout & Download

3. Key Elements

Element | Question | Comments |

Customers | Who are our customers in our today's business model? | Brainstorm names of real human beings or companies. |

Non-customers | Who are not our customers but could / should be in the future? | Keep in mind that we are only interested in non-customers who could / should become customers in the near future. |

Behavioural differences | What attributes help us understand behavioural differences between customers and non-customers? | Examples for behavioural differences are:

|

Behavioural commonalities | What attributes are characteristic for all customers and non-customers? | We don't consider those attributes to label the matrix. We just collect them to understand the borders of our market. |

Clustering | How can we classify our customers and non-customers into target groups based on behavioural differences? | The process of clustering may take a while. Play around with different labels of your axes and see what clusters you get. Good criteria to select a primary target group:

|

Get out of the building and follow the Discover Customer process to gain deeper insights from the real world or conduct a field study prior to a sprint.

4. Usage Scenarios

Analysing and visualising customer markets

Defining target groups for a business model

Phrasing "Job(s) to get done" statements

Identifying a primary customer segment