Discovering Markets

After discovering customers, estimating market sizes and analysing market conditions is also a very important task in the Discover Phase. In this article we introduce concepts, describe key activities and show dependencies on other discover areas.

Sabine Schoen

Business Design Field Researcher

1. Purpose

The market as a physical or virtual place where companies and customers can meet and exchange their offerings provides us determining conditions for our Business Design project. Discovering Markets is closely linked to Discovering Customers described earlier, since you need to define and understand your prospective customers and users first before you can go about the analysis of markets. There are a couple of things a project team needs to understand quite early in the process when it comes to market estimations:

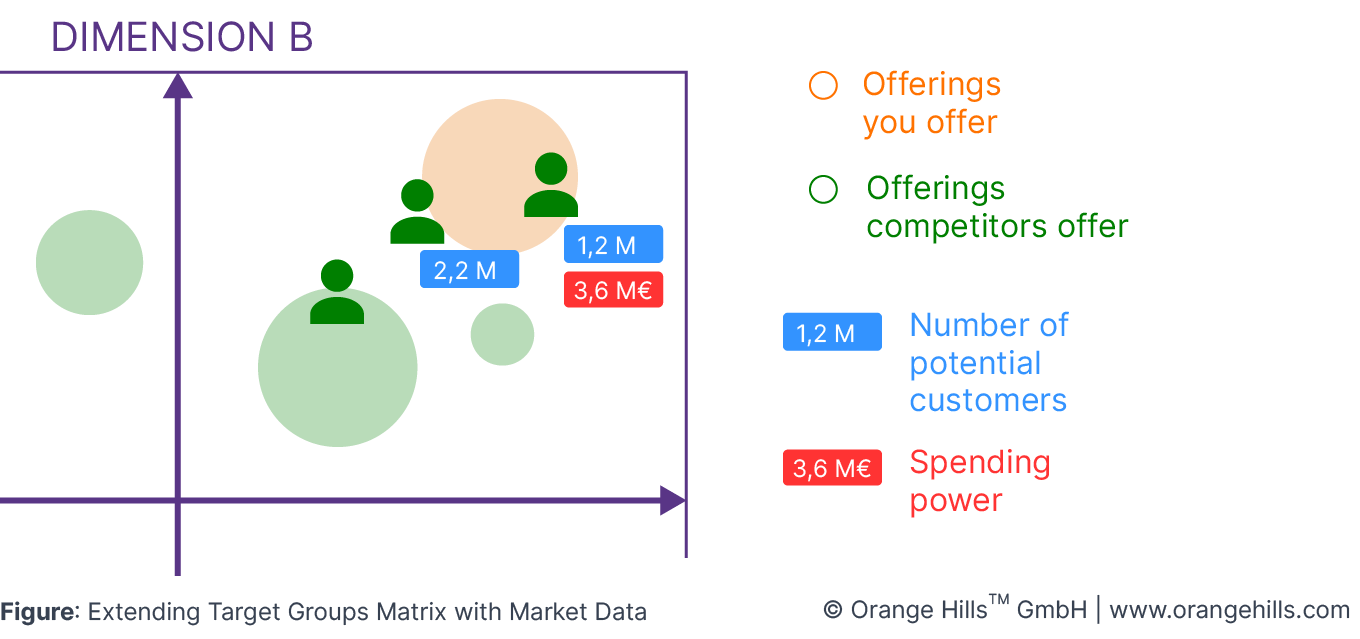

Number of prospective customers: Once you know who your customers are it is important to understand how many of them do exist in certain geographical regions. You can add this information to your Target Groups template for a visual overview.

Spending power: The spending power is the total amount of money customers spend for offerings related to the context of your Business Design project. These numbers are sometimes hard to get specifically for B2B niche markets. Market reports from research institutes are your friends here.

Bargaining power: Every market shows a distinct distribution of bargaining power between buyers and sellers. In some markets buyers can put pressure on sellers and negotiate prices and other conditions. In other markets it is the opposite.

Growth dynamics: And finally, it is also exciting to understand how the market attributes from above have changed over the last years and may change in the future.

Sometimes it is both difficult and too early to come up with a proper market analysis in the first weeks of a "fresh" Business Design sprint. If you don't know yet who your preferred customers should be, you don't know where to start and where to look at to analyse "your" markets. Understand your customers first before you invest too much time in a high-level market study. Very often we invest more time in a proper market analysis in the second iteration of a Business Design project.

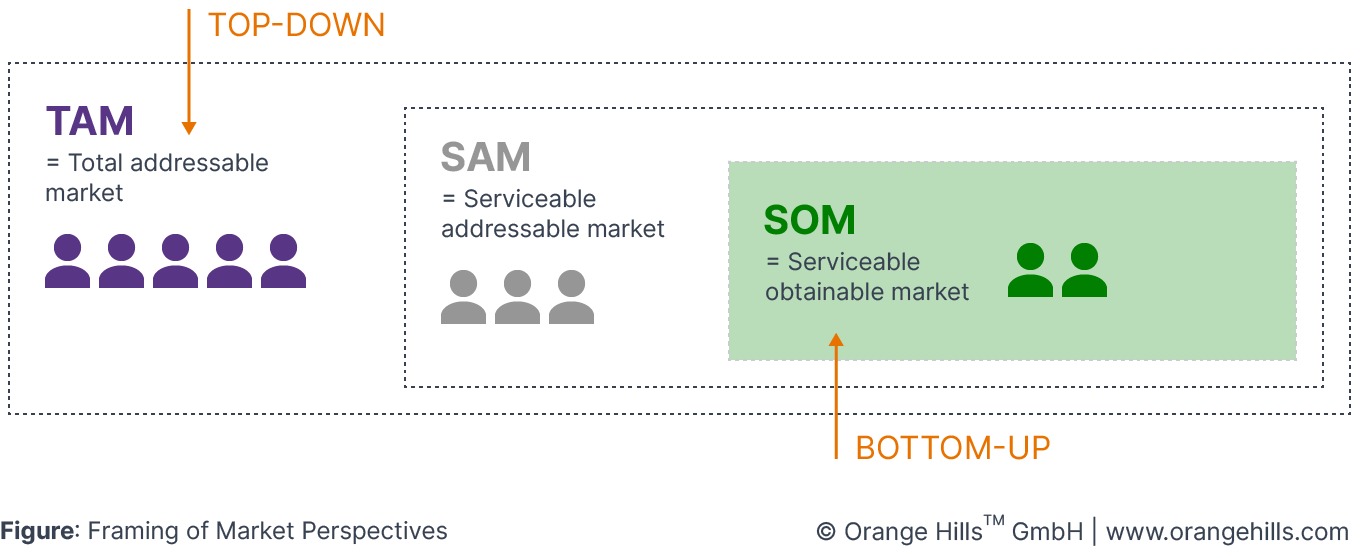

Another concept that is quite useful is the framing of markets. The total size of a market is often not relevant for us, since we can't reach out to all customers anyway. This is why we differentiate between two perspectives:

Total addressable market (TAM): TAM represents the spending power of all potential customers with a possible demand for similar products and services you are about to launch. This is the top-down perspective. Sometimes it is handy to break the TAM down to certain regions and customer segments which are relevant to you, the so called "serviceable addressable market" (SAM).

Serviceable obtainable market (SOM): This is the proportion of TAM that you can reach and provide customers with your products and services considering the resources you have at hand. This is the bottom-up perspective.

We suggest to consider both perspectives in a Business Deign project. However, the SOM is more relevant for short-term targets.

Keep in mind that innovators regularly change market sizes and conditions to even create totally new markets through disrupting new offerings and technology. Don't limit yourself with detailed market calculations. Your numbers don't represent the reality anyway. It is not about precision here, it is about getting a professional gut feeling.

Here is a simple example: Imagine your are about building a new kitchen appliance that can peel carrots, apples and pears. Your TAM is the total amount of money customers spend in similar appliances to get the job done of peeling these fruits and vegetables. SAM is the proportion of TAM covering only regions and customer segments you are interested. Say, professional chefs in European key markets. And finally your SOM is your share of SAM that you can reach with your marketing, sales and delivery power.

2. Duration

2,5 weeks

3. Key Activities

The following activities represent the core steps to discover markets:

Setup: Decide on your preferred customer segments for the next 3-5 years. Discover your Customers if required to gain a better understanding of their today's and future reality.

Conduct: Try to get as many information as possible around your TAM and SAM and with regard to your preferred customer segments from market studies, trend reports etc. Your top-down perspective. We know this task is quite boring, but there is no shortcut here. Moreover, consider the resources you have available over the next 12 months in terms of sales force, service or manufacturing capacity and estimate how many customers you can serve in this time frame to determine your SOM. This is your bottom-up perspective. Keep in mind that SOM is always smaller than SAM or TAM.

Review: Transfer your results to the Target Groups template and consider the numbers in business cases you may calculate in later stages of the project. Check out also this page for more information.