Financial Sanity Check

The Financial Sanity Check sheds light into the jungle of financial numbers and KPIs. Go through key elements and download the template for your team.

Content

1. Overview

As you have probably realized, Business Design doesn’t put too much attention on the numbers at the beginning of the innovation journey. The first challenge is not to get the numbers right but to find solutions that may ease a customer’s or user’s “job”. However, as time passes by and this solution / “job” - matching becomes clear, the prediction of future revenues and costs becomes key topic in the Business Design process. The guiding questions are:

What are the billable units in our business model?

How (often) do you aim to charge your customers how much?

What operational expenses may occur every month to finance your organization?

How much money do you need to spend before you earn anything?

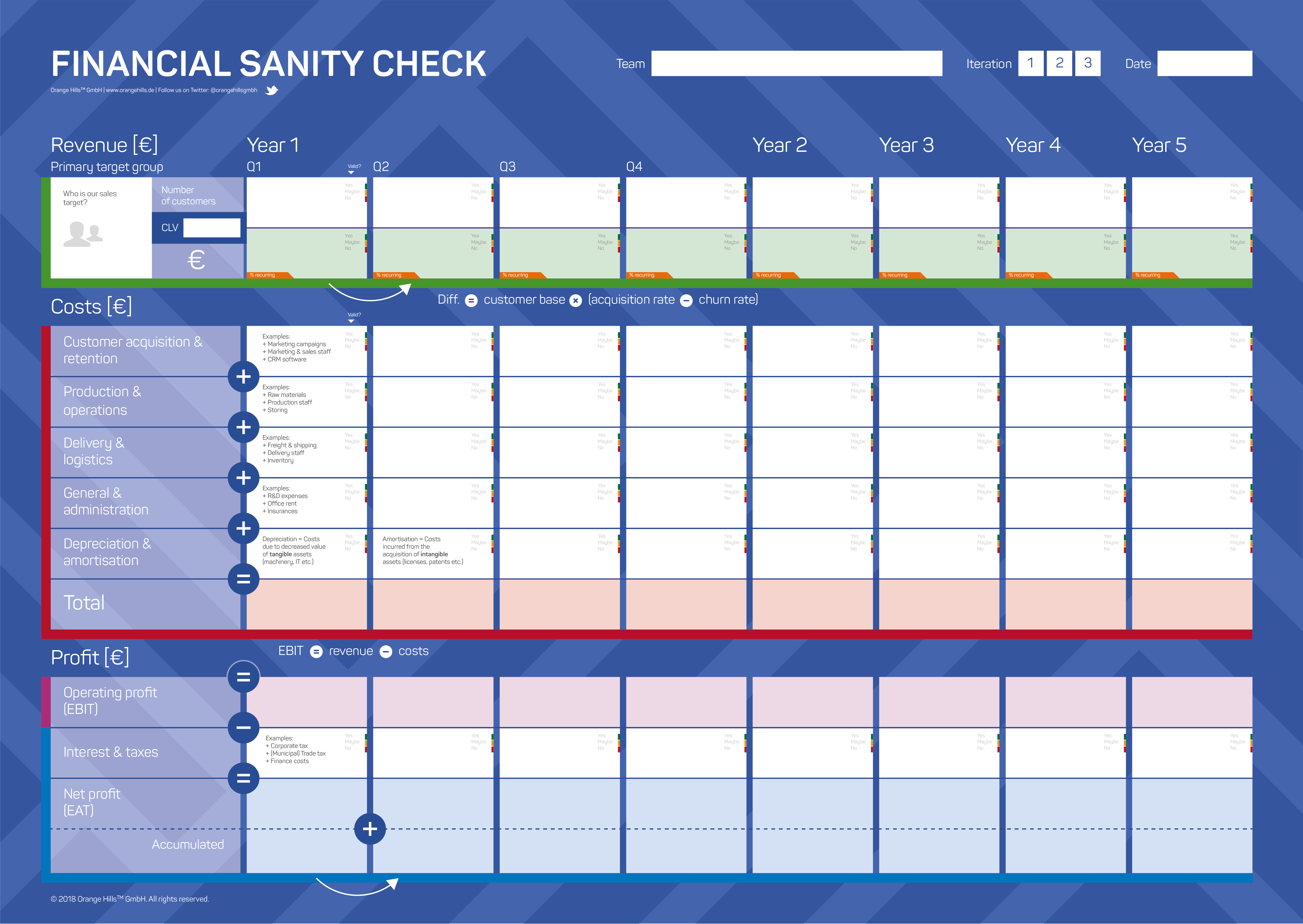

The Financial Sanity Check template helps you structure the discussions around these questions and sheds light into the jungle of financial numbers and KPIs (= key performance indicator). The template is not a fully-fledged business case with balance sheet, P&L statement, ROI calculation, investment estimation etc. It is a very simplified version of a P&L statement that allows us to get a good feeling of whether the business we are talking about in the Business Design process may lead to a decent profit margin. Thus, the basic idea of the tool is to estimate future

Revenue

Costs and

Profit

…along a timeline covering the next five fiscal years. The first year is broken down to quarters of 3 months, since the near future can be estimated more accurate than what may happen in year two to five.

2. Layout & Download

3. Key Elements

Element | Question(s) | Comments |

Revenue |

| Go back to your Business Model or Target Groups template if necessary to clarify what your primary target groups should be |

Costs |

| Link the costs to the number of customers you are aiming to serve in a certain timeframe. Depreciation and amortization is important only when you are dealing with asset-based businesses and huge investments in machinery or other infrastructure. |

Profit |

| Ignore interest & taxes in the first round and especially when you don't expect any profits and capital expenditures. |

4. Usage Scenarios

Detailing a business model in a Design Workshop

Preparing a Decide Workshop to support decision-making of sponsor

5. Instructions for Coaches

It is essential to have a very clear picture about your billable units before you start crunching numbers. Guide the project team’s attention to the whole life cycle of a customer. Maybe a product needs supplemental consulting, configuration or disposal services in order to work.

Try to link your costs to the number of customers you aim to serve in each timeframe (quarter, year etc.). Don’t think in head counts or positions.

Explain the cost categories on the Financial Sanity Check template step by step and give examples.

Let a project team brainstorm cost blocks first before you let them attach numbers to them.