Competitive Landscape

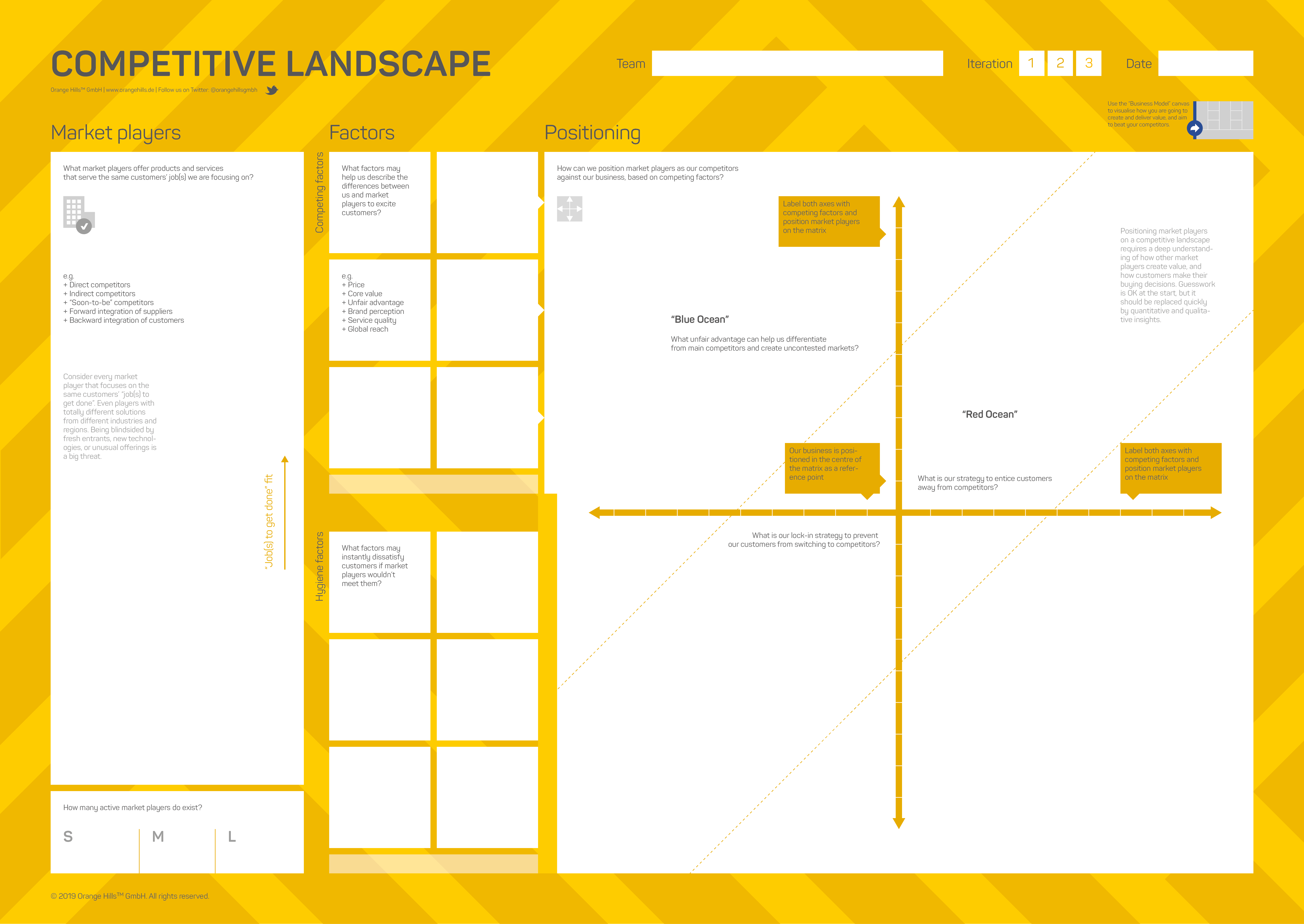

The Competitive Landscape template gives you guidance in how to segment competitors based on competing factors. Read more about key elements, usage scenarios as well as further instructions for coaches and download the template for your team.

Content

1. Overview

The idea here is that we identify competing factors that are important for customers to distinguish offerings from different market players and also have a significant impact on their buying decision. We group them into those factors that are important for customers to recognize differences between competitors (competing factors) and those factors that are absolutely mandatory to be compliant to (hygiene factors). While competing factors later will be used for the positioning in the matrix, the hygiene factors are "exclusive".

Running the competitive landscape exercise early in the process is a great way to find the right positioning for you and your new market offering and helps you to define a business model supporting this positioning. Running for a price-differentiated "red-ocean" strategy for example would mean that your company either gains competitive advantage from more efficient processes, cheaper resource acquisition or better deals with required delivery partners, compared to your competition. A technology leadership driven "blue ocean" strategy on the other side might mean that your business model needs to speak about which key resources and/or which key processes support this leadership position compared to your competition.

Coming up with such competing factors sounds easy, right? But experience has shown that spending more time on identifying less obvious factors is worth it because it enables you to create multiple "dimensions" of the positioning. You can then pick differentiating elements that help you to sustainably distinguish your offering from the competition. The general procedure is as follows:

Think about your (primary) target group and recall their "job(s) to get done".

Collect a bunch of actual or potential competitors. Remember to think broad at this stage and also include non-industry sector competitors. You can use the Competitor Sheet template (see downloads below) to document your initial competitor research.

Group them in the "Market Players" section based on how well their offering fits your primary target group's "job(s) to get done".

Brainstorm competing factors. Sort out hygiene factors into the lower section of the template.

Now, you are ready for a number of rounds of positioning: Put two random competing factors on the two axes (x, y), e.g. price and brand value, and place the competitors on the matrix accordingly.

Position your own company within that matrix in relation to the other competitors.

Review the matrix according to the following criteria: Is your position within the red-ocean sector? If yes, what can you do to move it to one of the blue-ocean sectors? Also, what are your "defense" measures to survive the red-ocean competitive situation?

2. Layout & Download

3. Key Elements

Element | Question | Comments |

Market Players | Which market players are offering the products and services that serve the same customers' job(s) we are focusing on? | Consider every market player that focuses on the same customer's "job(s) to get done" even if their solution might be entirely different to yours. Identify solutions that achieve the same result for the customer or probably just "feel" the same but using entirely different technology, resources, processes, etc. For existing companies, remember to identify soon-to-be competitors that could join in if current suppliers or customers extend their offering (forward/backward integration). |

Competing Factors | Which factors will help us to describe the differences between us and other market players to excite customers? | Examples for competing factors are:

|

Hygiene Factors | Which factors might instantly dissatisfy customers if we or other market players would not comply to them? | Classical hygiene factors could be things like:

|

Positioning | How can we position market players as our competition based on competing factors? | The process of positioning will be repeated several times and it might take a while to build up different perspectives on the competitive landscape around you. Play around with different labels of your axes and see what clusters you get. Positioning market players on a competitive landscape requires a deep understanding of how other market players create value, and how customers make their buying decisions. Guesswork is OK at the start, but it should be replaced quickly by quantitative and qualitative insights. |

4. Usage Scenarios

Analyzing and visualizing the positioning of competitors based on selected factors

Analyzing competitive situation (blue ocean / red ocean) and deriving required activities to address customers right

Identifying hygiene factors that relate to the own product / service specification

Identifying strength and weaknesses of competitors and linking it back to the business model

5. Instruction for Coaches

Get out of the building and do not rely too much on existing competitor intelligence to gain deeper insights from the real world. Consider DIY activities to research certain competitor positions when it comes to their products or services.

Make sure that while doing the positioning in the team that everyone is on the same page about the meaning of the competing factor as results and interpretation can dramatically change for even simple factors. E.g. price (high/low) might be an easy one but it makes a huge difference if you talk about your unit price being 140€ or your competitiveness according to price-levels of others. The first one is an absolut measure you use to position on one axis of the matrix whilst the other one is relational measure comparing your position in relation to the other players. You should be aware that the later approach does hold a lot of room for (mis)-interpretation and (mis)-judgment and consequently wrong measures reflected back to your business model.