Research & Development

Successful Business Design projects rely on fresh and surprising insights from research. Learn more about what kind of insights we are looking for and how we generate them.

Sabine Schoen

Business Design Field Researcher

Florian Czak

Creative Business Designer

Content

1. Purpose

We mentioned before that Business Design is an essential part of a modern innovation management system. But there is more needed to get innovation to the market. Business Design requires a very important ingredient: Fresh and (sometimes) surprising insights. Without new insights, it is almost impossible to create new ideas for products, services or business models. Creativity techniques can't compensate a lack of understanding of markets, customers' behaviour, trends or technology. We need to systematically and continuously dig into relevant Innovation playground(s) covering various research areas:

Customer behaviour in various segments

Market and societal trends

Technological trends (optional: IP databases)

Competitive landscape

Partnerships

Data & resources

Organizational strengths and weaknesses

Innovation playground(s) should be derived from a company's vision / "picture of the future" and strategic goals. This, however, is in many organisations a difficult endeavour. Why? Because many companies we have seen the last 15 years don't have a clear vision. They are excellent in managing their daily business but lacking an entrepreneurial idea for the future (well, apart from: "let's increase revenue by 10%"). If this is the case, we might end up in big troubles. Keep this in mind!

2. Research Areas

The result of this phase is documented knowledge (plus formulated trigger questions, see 5. below) that can be used and digested in ideation sessions either before a Business Design sprint or during a Design Workshop. And this is not that easy. The following table gives you a first impression what research in these areas may look like:

Area | Methods (Examples) | Result format |

Customer behaviour |

|

|

Market and societal trends |

| Short trend reports with implications to business lines |

Technological trends |

| Short technology reports with implications to business lines |

Competitive landscape |

|

|

Partnerships |

| List of partners for research, sales, merger & acquisitions and don't forget the start-up cosmos |

Data & resources |

| List of available data pools incl. quality criteria and other resources that have a unique character |

Organizational strengths and weaknesses |

| SWOT analysis |

Again, research can be almost meaningless if we are not able to gather fresh and (sometimes) surprising insights. A simple list of competitors with name, URL, number of employees and annual revenue of last fiscal year is a good start, but we don't learn that much for our projects. If we were able to get valid information, why our No. 1 competitors failed in their innovative "direct-to-consumer" marketing campaigns, inspiration will come instantly.

3. Guided Field Study to Understand Customer Behaviour

In some cases, we recommend to conduct a guided field study to better understand customers and users. The reason for that is, that many of our clients are willing to develop new products and services based on customer needs - but do not really know how to find and understand them. Typical market research, customer segmentations based on demographic attributes or even fake personas do not really help to design something new. In addition, many employees are missing direct contact to customers and users to see how and why their offerings are used. But some tend to always ask the same customers ("buddies") for feedback.

A guided field study to better understand your customers and users is a great way to get your employees and colleagues out of the building and into the world of your customers and users. That reveals innovation potentials based on customers needs automatically. After a field study, you can easily pick a specific primary target group to start Ideation and tailor your offering to their specific needs.

The purpose of the field study is understanding your customer and / or user groups in detail (behaviors, needs, emotions and preferences) and come up with a customer segmentation based on behavioral patterns (within a Target Groups Matrix). Describing your target groups based on real data is the best foundation to start (strategic) discussions about your current position in the market and identify potentials for innovation.

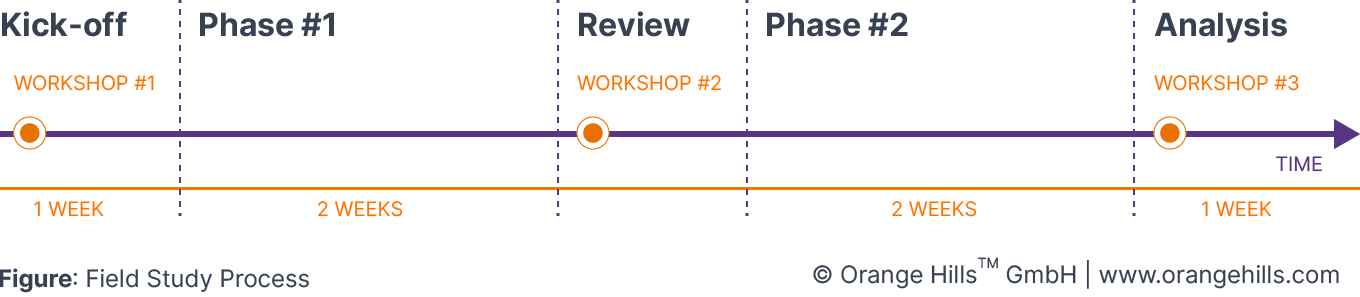

We follow a structured process when we conduct a qualitative field study:

Kick off field study: In a kick-off workshop, we make a first draft of the Target Groups template by defining customers and non-customers based on behavioural attributes. We decide on the customer and user situation we want to gain a better understanding of and identify suitable and "diverse" participants for the first iteration. Furthermore, we select our research method(s) (e.g. observation, diary, interview, collection of quantitative data, desk research, etc.), start preparation (e.g. guidelines, templates, schedule appointments, etc.) and train the team how to conduct the research (e.g. interview training).

Conduct field study (first iteration): We conduct the first iteration of our field study according to our research agenda and capture results (sound, pictures, videos, reports). A research expert accompanies the team (e.g. in first interviews) to ensure quality and help the team to improve their research technique.

Review results: In a review workshop, we share intermediary results in the project team by presenting our analysed customers and users and position them on the Target Groups template. We reflect and adapt our behavioral attributes, revise the customer and user selection and research agenda for the second iteration.

Conduct field study (second iteration): We conduct the second iteration of our field study according to our revised research agenda and capture results (sound, pictures, videos, reports).

Analyse results: In an analysis workshop, we present our interviewed customers and users from the second iteration and complete the Target Groups template. We analyse our target groups matrix and enrich it with gathered meta information (see detailed analysis steps here). After the workshop, we prepare a final report including our target group segments represented by Customer Cards ready for Ideation.

4. Desk Research to Understand Trends

A trend analysis helps you to understand the development of future needs and circumstances. Trends can be analysed at different levels and from different perspectives – your entry level highly depends on your innovation playground(s). The basic procedure includes an iteration from holistic, long-term trends to topic-specific, current dynamics:

Mega trends: The entry level here is that of megatrends. They describe general, long-term (over decades) and global changes in the interaction of society, technology and the economy. First of all, an overview of all megatrends and their mutual interrelationships should be compiled in order to gain an understanding of the way in which they influence your innovation playground(s) - this knowledge allows a playground-related sorting of the trends according to direct correlation. Subsequently, deeper research and data collection (quantitative and qualitative) on the most relevant trends helps to understand them in detail and reveals subcategories. You may end up here with five megatrends especially relevant for your playground(s) and corresponding data you identified like quantitative predictions from trend forecasting institutes or qualitative descriptions from trend reports. An overview of megatrends incl. their subcategories and dynamics is offered by “Zukunftsinstiut” (see box below). An example for a megatrend is “Silver Society”.

Socio-cultural trends: The identified subcategories can in turn be projected to the next level down, that of socio-cultural trends. Socio-cultural trends are medium-term processes of change that have their core in social processes and forms of organisation. Even though certain focal points have already been identified here from the previous process, it still makes sense to get an overview of the totality of socio-cultural movements and their interrelationships. The analysis of the trends to be focused on again follows the same pattern as at the level above: collect qualitative and quantitative data (white paper, reports, articles, etc.), clarify the connection with your innovation playground(s) and form clusters. An example for a socio-cultural trend as subcategory of the mega trend “Silver Society” is “Liquid Youth”. Accordingly, the subcategories developed are the focus basis for the next trend level.

Consumer trends: Consumer trends describe short- to medium-term developments with a concrete market reference. The previous iteration loops allow the focus on consumption trends with concrete reference to your innovation playground(s). Here, too, the same analysis scheme is worked through as at the previous levels. An example would be “Telemedicine” and corresponding statistics on their consumption.

Technology trends: Technology trends should also be part of any trend analysis, but in the human-centered perspective they are considered as enablers and are not the focus of the elaboration - in this case, only an overview is elaborated that allows assumptions to be made about the future feasibility of solution approaches. Please find an overview of potential sources in the box above.

Finally, in the course of a synthesis phase, all collected and categorised data are elaborated into a framework of trends that describes the future scenario within your innovation playground(s) in a comprehensible and tangible way. In the course of this, it is helpful to contrast the identified trends with basic human needs, specific needs and activities (you identified in your customer research) to make their relevance understandable for specific groups of people (what do people why in your context?). An example is “being mobile” as a basic need. All resulting findings are summarised and processed in an internal trend report including selected opportunity areas (e.g. “How might we enable the silver society to stay mobile without looking invalid?”, see 5. below) as input for ideation.

An overview of megatrends incl. their subcategories and dynamics is offered by “Zukunftsinstitut” here

The most important consumer and lifestyle trends as well as well-founded forecasts are published by platforms such as "WGSN"

Market and social research institutes such as the "Sinus Institute" also disclose detailed information on social developments

Quantitative data collections of any kind are summarised by "Statista" in topic dossiers

Studies and reports are often commissioned and provided by governmental and non-governmental organisations. It is therefore always worthwhile to look for findings from ministries and companies that appear to be close to the relevant topic.

5. Trigger Questions for Ideation

At the end of the research phase, the goal is to gather everything that has been learned. For this purpose, various methods already explained above can be used. As we are in the transition from the research to the ideation phase it is helpful to process the insights in a way that they provide a good basis for creative ideation. Therefore, we love to translate research results into "How might we (HMW) questions" as input for ideation (next to our detailed research results). The formulation of an HMW question helps to put already existing ideas (like the most obvious first guess) on the back foot again to start the ideation phase with an open mind.

However, to narrow down the possible solutions in a meaningful way, it is advisable to consider the following components when developing the questions: It is important that the HMW question refers to the insights concretely and addresses a specific problem without including a solution approach. Negative example (no problem statement, includes solution approach):

How might we make our offering more innovative by including a digital service?

The goal of the HMW is to open a solution space. If the question already contains an idea, the possible solution spectrum is limited. Furthermore, if the question is formulated too broadly, without a problem definition, it can happen that the ideas developed do not fulfill the needs of the selected target group or do not solve the core of the problem. However, the HMW question should not only focus exclusively on the problem to be solved or the need to be met, but also describe the goal to be achieved by solving the problem. The goal in this case should represent the benefit for a specific target group. Positive example:

How might we develop an offering that gives insecure people with physical limitations confidence to live self-determined at home for longer?

After conducting research in the described research areas, think about formulating HMW questions as trigger for ideation and check their quality by the help of the list below. During the ideation workshop, the HMW questions should be presented in combination with the insights in a way that is comprehensible for all participants.

Is there a problem statement that has arisen from the research that can be included in the HMW question?

Is there a certain target group with specific needs that your HMW question should be focused on?

Does your HMW question include a goal without presenting a specific solution?