Discovering Customers

This article is for sprint teams just starting their activities to better understand their customers and users in the Discover Phase. We explain the next steps to prepare and conduct your research and provide corresponding tools. Our goal is to generate surprising insights for the Design Phase.

Sabine Schoen

Business Design Field Researcher

Content

1. Purpose

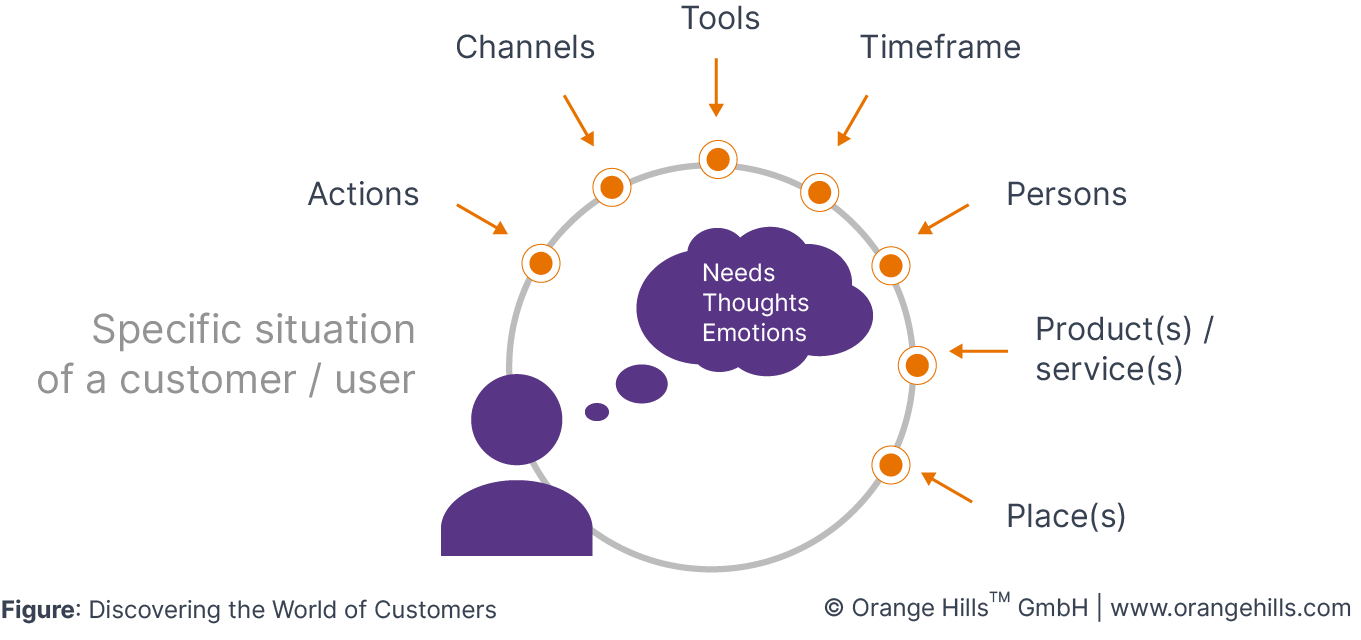

Discovering customers and users gives your team access to authentic first-hand impressions about their current world. This helps your team to develop a deep understanding of behaviors, needs, emotions and preferences relating to relevant situations towards your project scope. It will fuel your discussions in the Design Phase to come up with ideas that are based on new and surprising insights. In the area of discovering customers we often hear that the goal is to solve paint points. Keep in mind that most of the time it is not about finding a big pain point no one solved before. Solely focussing on pain points can be enough in areas where there has not been much innovation in recent years or if the scope of your project does not allow you to rethink specific situations (and address underlying needs instead). But usually pains are just one piece of the puzzle. It's more about understanding how customers act and feel(!) in a specific situation today as basis to create a new one. Solving existing pain points in the "old world" may be irrelevant in the "new world".

Great insights can be generated by Customer Interviews, Customer Observations and DIY (= Do it yourself). Next to these three methods, expert talks (e.g. with employees from customer support, sales or dealers) as well as existing data about the usage behavior of customers (e.g. stored in internal databases / CRM see Quantitative Data Analysis) can generate insights from different angles. You will achieve the best results when you combine several approaches (see triangulation in the Discover Phase). Obviously, the time and money you spend to discover your customers should bear relation to the project scope. The challenge here is, however, that interviews and observations need to be well planned. Since they are time-consuming, we usually can't talk to or observe too many people. We need to pick the "right" people and create a diverse sample in order to gain relevant insights.

It's not easy to have useful conversations with customers. Make sure that your interviewers are trained in advance and ask the right questions to collect data as neutrally as possible. Take care to mitigate Confirmation Bias as well as Response Bias by applying the right interviewing technique. Learn more on our page about Customer Interviews.

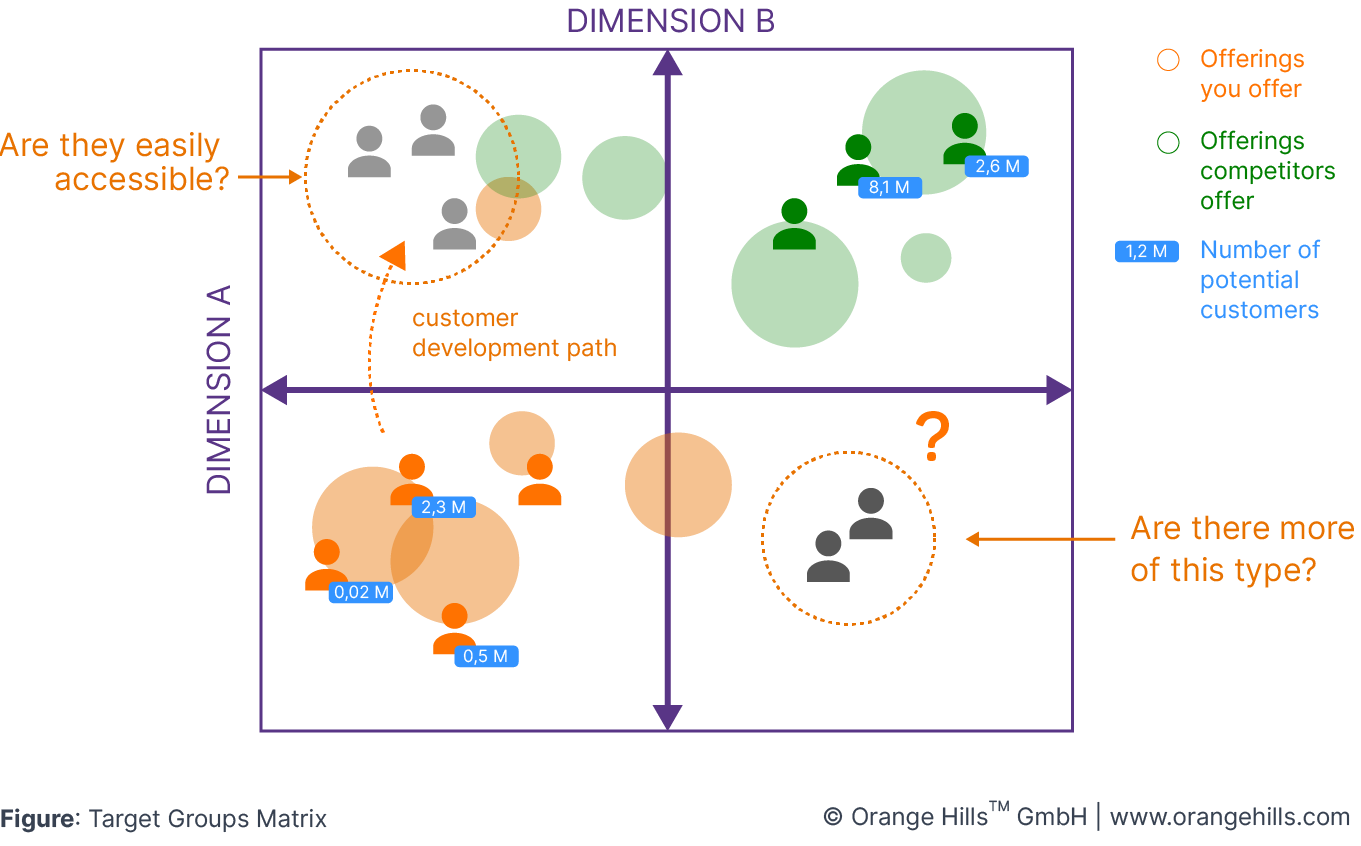

The purpose of all these activities is understanding your customer and / or user groups in detail (behaviors, needs, emotions and preferences). Having all these insights gathered, a Target Groups Matrix helps your team to come up with a customer segmentation based on behavioral patterns. Describing your target groups based on real data is the best foundation to start discussions about your current position in the market and identify potentials for innovation. The matrix features 1-3 dimensions with placeholders for interviewed people and various overlays for additional meta information (see example below).

Typical analysis steps are:

Behavioural segmentation of customers: What attributes help us understand behavioural differences between customers and non-customers? How can we classify our customers and non-customers into target groups based on behavioural differences?

Description of segments and selection of representatives: What characterises each segment? How do they behave in the situation that is relevant for us today? Is this segment e.g. open-minded, easily accessible and ready to spend?

Identification of customer development paths: Who do we want our customers to become in the future (e.g. moving them up in the matrix)?

Positioning of own and competitors offerings: Which segment do we serve today? Which segments do our competitors serve today? Are there any white spots no market player is serving today? Learn more about it in our article about Discovering Competitors.

Quantitative description of segments: How many (non-)customers are on the market for each customer segment? What are our onetime acquisition costs for new customers in each target group? What lifetime value can we generate with customers in each target group? What segment unlocks the most value in our business tomorrow? Learn more about it in our article about Discovering Markets.

2. Duration

If your level of knowledge about the world of your customers and users is high, you can clarify matters of detail within the scope of the Discover Phase (2,5 weeks).

If your level of knowledge about the world of your customers and users is low, we recommend to conduct a field study prior to the Discover Phase in a separate field study project or, in rare cases, extend the Discover Phase.

3. Key Activities

The following activities represent the core steps to discover customers:

Setup: Decide on the customer & user situation you want to gain a better understanding of to scope your activities. Identify suitable and "diverse" interviewees or places where you can observe your customers & users and prepare your interview / observation guideline. Decide on channels, products & services you want to use for your DIY activities. Define who else you can talk to (expert talks with customer support, sales or dealers), what existing behavioral data you could use and schedule your next steps.

Conduct: Conduct your research according to your observation / interview guideline and capture results (sound, pictures, videos). A research expert may accompany first interviews (coaching-on-the-job) to ensure quality and help you to improve your research technique. Also, start your DIY activities, expert talks and desk research (e.g. Quantitative Data Analysis).

Review: Document the results in a visual way and share them with your team (e.g. Customer Card or a Mind Map). Analyse your findings together and enrich it with additional information (see Target Groups Matrix Analysis above). Define your primary target group(s) with a "Job(s) to get done" statement for your Business Model.

4. Participants

(Potential) Customers

5. Tools & Materials

Good customer research takes time, courage and effort.

We are always looking for tools to help us. As part of this mission, we recently tested the Synthetic Users tool. At first sight, we were impressed by the way it presented the interviews with the synthetic (AI) users. The more we looked at it, the more we found some weaknesses. So if you are looking at synthetic user interview results, please be aware that

We may lose sight of the details, e.g. situational context, cognitive dissonance

We miss the opportunity to develop customer movements

There is no emotional connection between the researcher and the researched (which is so valuable and important for the rest of the innovation project)

The team may lose the willingness to accept uncomfortable answers because the answers are not seen as "real" but artificial

Synthetic interviews can be misused to justify projects

6. Q & A

Shall I conduct interviews or observe customers & users? It depends on the access to your customers and users and if you have the chance to observe them in the situation relevant to you with as little interference as possible. If this is no problem, social roles, workarounds, subconscious behaviors and emotions are often easier to observe than to enquire about. In the best case, try to combine both methods.

What do you mean with triangulation when discovering customers? Are interviews not enough? Let's say you want to understand how your customers use a certain service. What methods would be useful to apply? First, you want to talk to them about the last time they actually "used" the service. You can also watch them while using the service. And, you can immerse yourself into the service experience ( = Do it yourself). The results coming from theses different methods may vary, since there is often a huge difference between what people say they do and what they actually do. Experiencing a customer process or service yourself, will help you understand your customers and their answers. Try it out!

How many interviews / observations are enough? It’s all about getting a "professional" gut feeling and not finding the ultimate truth. That’s why the amount of interviews / observations depends on you and your findings. Stop your research when your learning curve starts to flatten out. Experience has shown that this happens after less than 15 cases across customer segments.

How do I find the right interviewees? There are many options to identify potential interview partners. Discuss different options in your team based on your defined scope. Possible ways to find interviewees are: Ask your sales and / or support team to provide contact details, check your customer management system and identify e.g. customers that became non-customers during the last year, use your personal network to identify potential interviewees and ask colleagues to do so, go to places, conferences or events where your customers or customers from your competitors might be and try to make contacts, use social media, business networks or organizations to get in touch with them etc. And do not miss the chance to build a pool of people you are allowed to contact again!

Is one iteration enough? It’s not easy to come up with the perfect interview guideline from the beginning. During the first interviews you will learn a lot about how to improve your guideline or the selection of your interviewees. It’s important that you are open to adaptions and review your approach after a few interviews.

We usually do traditional market research with a high amount of participants. How can I make sure that we derive valid segments with less than 20 participants? We believe that traditional customer segmentation based on demographic attributes (e.g. income / budget or household / company size) do not help us to know what our customers need. But when we understand their behavioral patterns in detail (e.g. in an interview) it is pretty easy to identify an offering that fits their needs. The derived segments can then be validated and quantified by the help of a lead management tool.

7. Discovering Customers vs. Traditional Market Research

If you've read this article, you've probably already noticed: There is a huge difference between discovering customers as a foundation for your sprint vs. traditional market research. Let's have a look at the most important differences.

When you are discovering customers... | When you rely on traditional market research... |

|---|---|

...you talk to / observe a small amount of people (e.g. 10-15) to discover in-depth details about their lives | ...you talk to / observe a large amount of people (e.g. 50-100) to obtain specific data |

...you focus on new, surprising and even conflicting information | ...you focus on completeness, objectivity or statistically validated data |

...you identify behaviors, needs, emotions, motivations and preferences | ...you identify less fuzzy details you can count easily, e.g. how often a problem is mentioned |

...you segment the market based on behavioral attributes (yes, also in the B2B world!) | ...you segment the market based on demographic attributes (B2C) or details about the business like sectors, budgets, company sizes, products (B2B) |

...you do the research on your own (conduct interviews / observations, analyse results, etc.) to argue and design on behalf of your customers later on (by the help of Customer Cards) | ...you find experts to do the market research for you and enjoy the filtered summary including proven information presented by digestible charts and "fake" personas |

...you probably struggle for appointments and suffer due to the time-consuming research work and documentation | ...you only have the challenge afterwards when it comes to deriving insights |

...you have fun because identifying potentials for innovation happens automatically - your brains are full of ideas | ...you do not really know what to do afterwards based on the results because many questions are still open |

...you will always remember personal talks or observations of potential customers | ...you forget about the details quickly - it was just one more PowerPoint presentation in your live |

There is one more thing: Discovering customers and identifying pain points is a great starting point for your next innovation project. Very often this is enough and you are good to go. Sometimes, however, when your industry is "over-analysed" already, we suggest to create a "vision" for your customers by asking the question: Who do you want your customers to become? ...and think about what you can do to develop respectively enable these customers (see also "Picture of the Future")? DIY stores are a good example for this: Many DIY stores want me to become somebody who is able to "build" things for my home. "Do It Yourself!" And they do a lot to get me to that level.